Share

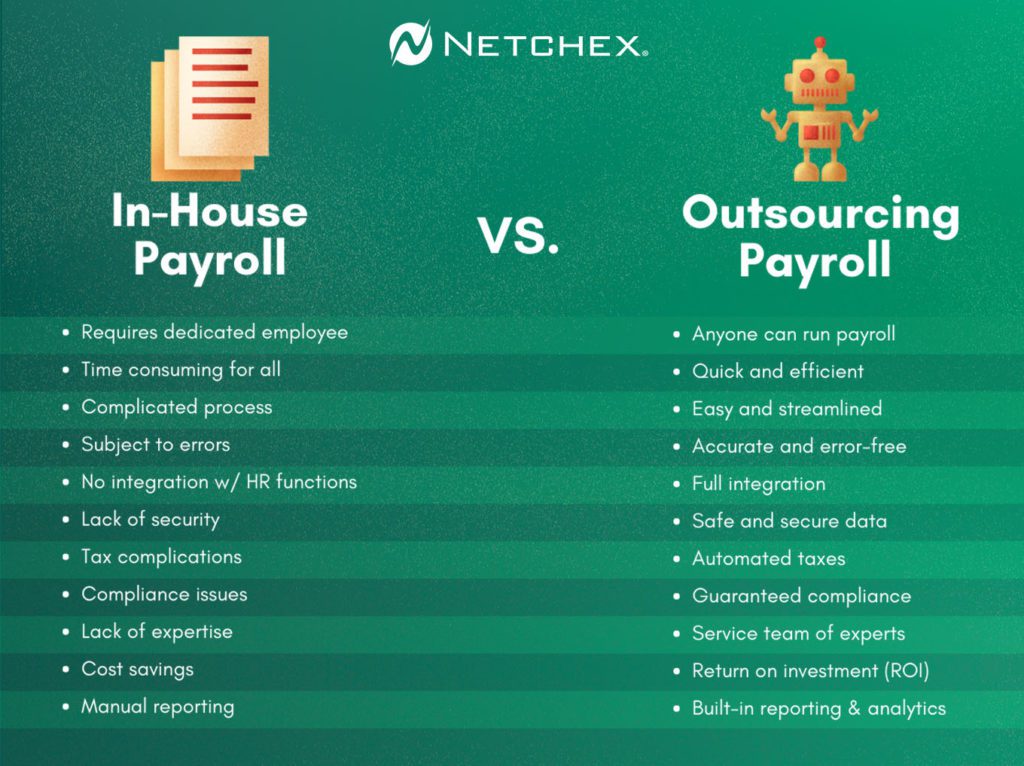

How to handle payroll processing is a question all businesses must consider. Small business owners might be able to manage payroll themselves, but it takes time and is susceptible to errors. Medium and large businesses can justify hiring a dedicated HR professional, but time, errors, and cost are still less than ideal.

The right software solution can make payroll tasks faster and easier for all size businesses. When you need to make the most of every employee and investment dollar, outsourcing payroll can make your company more:

- Productive

- Efficient

- Cost-effective

How should your company be processing payroll? Let’s compare in-house payroll vs. outsourcing with payroll software:

Specialized employee -vs- Anyone can manage payroll

Between the ever-changing tax laws and the mystery magic of Excel spreadsheets, you’re going to need a skilled employee to handle payroll in-house. Is a dedicated employee the most efficient option for your company?

For payroll processing, outsourcing is easier for anyone in the office to manage the paperwork with payroll software.

Time-consuming for all -vs- Quick and efficient

The old school way of crunching numbers and paperwork is tedious, repetitive, and cumbersome. Correcting an error can be annoying, time-consuming, and even costly. Plus, dealing with employee questions and requests can hinder timelines.

The alternative is outsourcing the work with user-friendly software. HR software saves more time when it connects multiple systems, like with timekeeping and new employee onboarding. Employee self-service also takes much of the administrative lift off of your HR team.

Complicated process -vs- Easy and streamlined

If you think payroll processing isn’t complicated, then you should learn more about the tax penalties and deadlines. Bookkeeping skills and knowledge of tax regulations are essential for anyone running payroll manually.

Payroll software can make the process significantly easier for those of us who aren’t CPA’s. Once you have everything properly set up and employee information entered, actually running payroll should only take a few clicks.

Subject to errors -vs- Accurate and error-free

It’s easy to make mistakes when manually copying between spreadsheets and repetitive, time-consuming tasks. When custom software automatically runs payroll, however, you’ve removed the opportunities for human error. The calculated results will directly (and accurately) reflect the input information from time clocks and other linked systems.

No integration with other HR functions -vs- Full integration

Manual payroll is difficult to streamline and nearly impossible to fully integrate with other HR software. If you upgrade your attendance and onboarding software, the upgrades probably won’t make a big difference to the people processing payroll.

With outsourcing payroll, you can connect multiple software solutions to make them both more efficient. Netchex offers a full suite of HR technology solutions on top of payroll, including recruiting & onboarding, benefits administration, performance management, and more.

Lack of security -vs- Safe and secure data

Data leaks frequently make the news, and ransomware attacks are only one of many security threats. When you outsource payroll, the service provider has the incentive and expertise to protect your data security.

Complicated taxes -vs- Automated taxes

Do you know how to correctly classify exempt and non-exempt employees? Tax withholdings and changes to local, state, and federal tax laws all make the tax process complicated. With payroll outsourcing, you can skip the guesswork and submit taxes automatically.

Compliance issues -vs- Guaranteed compliance

Doing your own payroll, you’re liable for any compliance issues with taxes and other regulations. You’ve got to classify workers correctly and beware of issues like overtime laws. When you outsource, the payroll company has experts who can guarantee compliance.

Lack of expertise -vs- Team of industry experts

Even if you hire someone with years of payroll processing experience, it can be hard for any individual to keep up with changes to tax law and regulations. Another advantage of outsourcing is gaining access to that wealth of payroll-specific knowledge from a service team at the ready 24/7.

Cost savings -vs- Return on investment (ROI)

Many businesses stick with their current payroll system because it works “well enough” and upgrading would be an added cost. They often fail to appreciate the future savings that would come from outsourcing and simplifying payroll. Outsourcing reduces the work hours needed each pay period and prevents costly mistakes—greatly increasing your ROI for years to come.

Manual reporting -vs- Built-In reporting & analytics

Reporting is important for improving your business’s performance and efficiency. Unfortunately, it’s not very efficient to convert manually compiled payroll data into internal reports. With outsourced software, the reporting and analytics are automatically included, providing useful data without creating yet another task.

If you’re interested in learning more about payroll processing and other HR solutions, the team at Netchex can help you determine what software would be the best investment for your company.

This article is part of our comprehensive payroll management series.