4.7

|

80+ REVIEWS

4.7

|

80+ REVIEWS

Employee Benefits Administration Software

6,500+ organizations trust Netchex

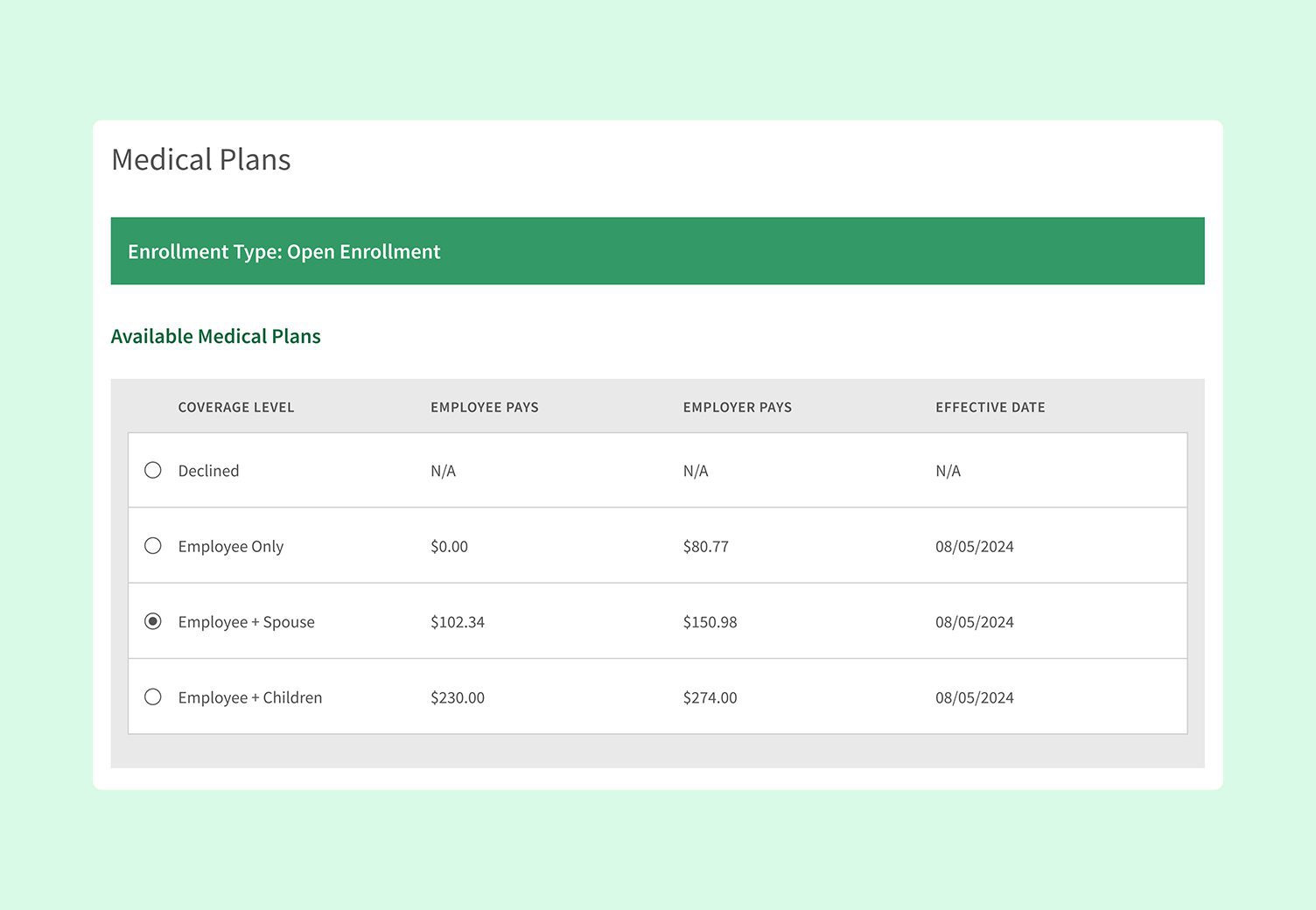

Enrollment & Administration

Easier enrollment and management empower employees to better control their benefits coverage via desktop or mobile.

Carrier Communication

Eliminate the manual tasks associated with Carriers via digitized forms, EDI feeds, or NetEnroll.

COBRA Administration

Employees won’t have to worry about the loss of benefits when they are in between jobs.

Healthier, Happier Employees

HMO and PPO without the OMG. Effortless benefits enrollment and uncomplicated management, our benefits solutions empower your employees to take control of their health coverage at the office, at home, and on-the-go.

NetBenefits

A sophisticated system. Mobile-friendly access. A people-centric portal. All the intricacies of benefits outsourcing and health insurance services—without the headaches.

Multiple Options for Carrier Communication

EDI Feeds

Eliminate the manual tasks of submitting forms or entering information into your Carrier’s or third-party administrator’s website with an automated enrollment data feed.

Digitized Forms

Digital Forms provide pre-populated forms that are signed and submitted to Carriers electronically, eliminating the tedious manual HR and employees process of filling out forms to communicate enrollments, renewals, and changes.

NetEnroll

Ensure every employee receives professional education on your company’s benefit plans and a customized enrollment experience no matter when or how they are onboarded. HR and brokers can offload the time consuming task of educating and enrolling every new hire.

ACA Compliance and COBRA

Manage compliance with benefits administration software, saving time and money through guided reporting and automation.

ACA Dashboard

- Automatically manage ACA periods

- Track hours for every employee

- Create ALE and FTE reports

- Generate and file Forms 1094-C & 1095-C

COBRA Administration

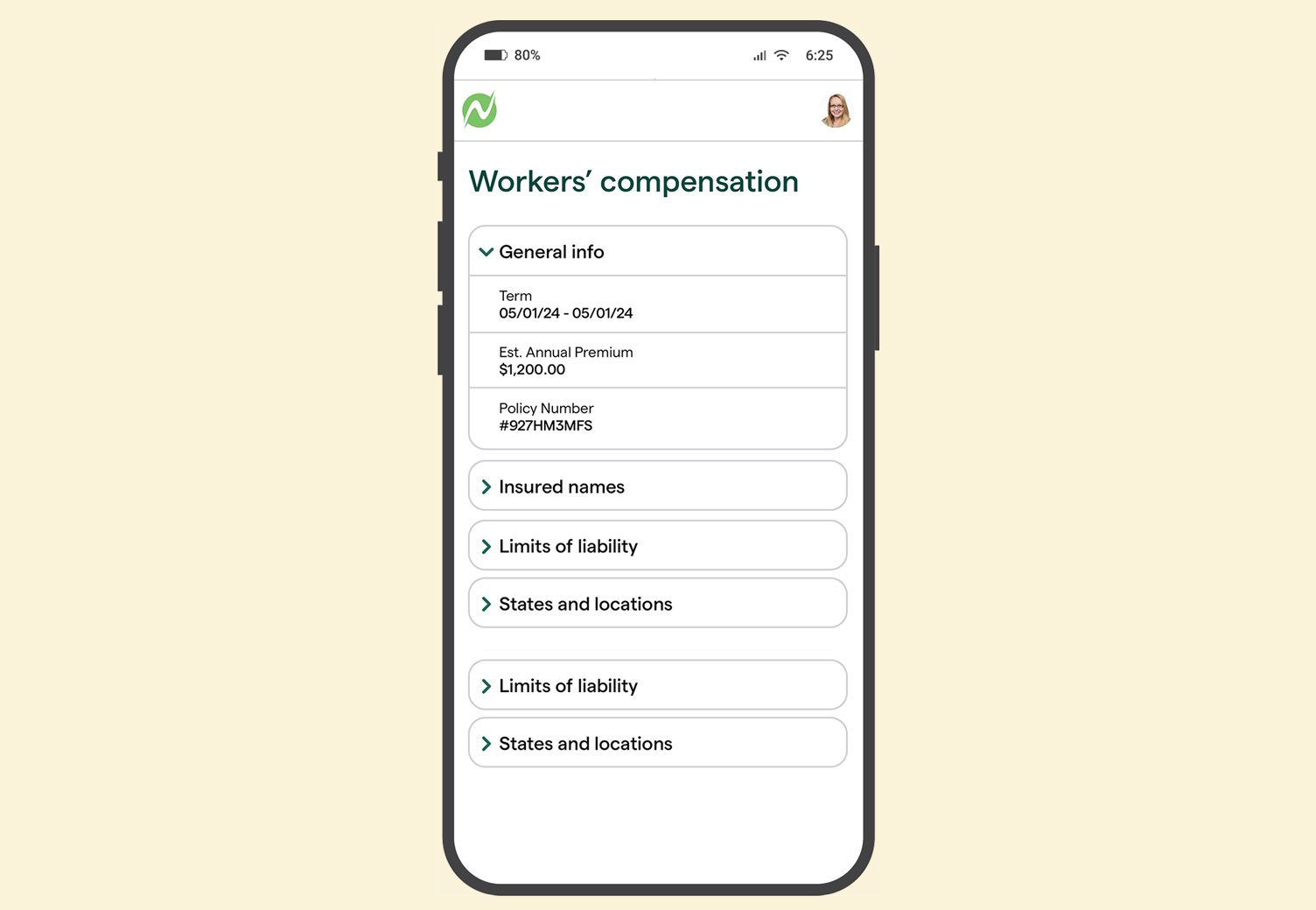

Integrated Pay-As-You-Go Worker’s Comp

Netchex’s seamless integration with workers’ compensation automates payments and saves you time and compliance worries.

- Data synchronization: Eliminate the need for manual data entry and reduce the risk of errors while saving time and effort.

- Cash flow benefits: You pay your premium one payroll period at a time, avoiding the large up-front cost of traditional workers’ comp policies.

- Easier workers’ comp audits: Your premium is calculated based on your actual payroll, for accurate payments and simpler workers’ comp audits.

Featured Case study

Dexas

Dexas was searching for dependable payroll services (with unlimited payroll processing), benefits administration (including eligibility tracking and consistent enrollment), and HR support (such as onboarding and task management). For this and more, Stephen knew Netchex would be a great fit for Dexas, thanks to our true single-source technology and award-winning customer service.

Discover a new level of excellence in technology & customer service with Netchex.

Benefits Administration 101

Employee benefit plans not only help employees and give a sense of security, but can help your company in many other ways as well. When done effectively, employee benefits can also be a major recruiting and retention tool.

Outside of those few benefits required by law, a diverse and expansive benefits package shows that your company is invested in the wellbeing of employees—giving you an edge against competitors.

While the positives of providing employee benefits are evident and many, the behind-the-scenes management of employee benefits can be a major undertaking for most businesses. Because it is so important and multi-faceted, employee benefits administration takes a significant amount of knowledge, time, and effort to manage across your workforce. It is an important role to fill by your HR team.

Thankfully, integrated HR technology is available to make Benefits Administration quicker, easier, and stress-free. Let’s take an in-depth look at:

What goes into Benefits Administration

How HR technology makes Benefits Administration easier

Getting the most out of employee benefits plans

Creating a better benefits enrollment experience

Working in-sync with employee benefits brokers

Remaining in compliance from a benefits perspective

73%

of work is taken up by HR administrative tasks, including benefits-related work.

Source: Center for Effective Organizations

What is Benefits Administration?

Benefits administration is the organization and management of benefits-related tasks for your company. At most companies, benefits administration is the responsibility of the Human Resources department.

Here are just a few of the most common employee benefits. Most of them need to be explained and managed on some level by benefits administration staff:

Health insurance

Dental, Vision, and Life Insurance

Disability and Sick Leave

PTO and Family Medical Leave

Retirement Savings

50%

expecting further increases in the next three years

source: Guardian

A majority of employers have increased their spending on benefits-related technology in the past 10 years, with more than 50% expecting further increases in the next three years

Benefits Administration Involves

6 a multitude of tasks, some of which can be automated or outsourced. Integrated HR technology improves the efficiency and accuracy of benefits administration.

- Most benefits will need to be managed throughout each employee’s lifecycle

- Annual open enrollment and life change events must be conducted

- During onboarding, new hires must be educated and complete lots of paperwork

- Likewise, departing employees need to informed of continuing coverage and COBRA

Without Proper Benefits Administration

Without proper benefits administration, your company and your employees may be left vulnerable to:

- Failure to comply with legislation can result in expensive fines

- Miscalculations and omissions in can lead to significant liabilities and expenses

- Missed insurance payments could leave employees uninsured

- Poor bookkeeping could leave your company paying for benefits you shouldn’t be

What is the role of a Benefits Administrator?

A benefits administrator serves as an advocate for employees and manages the full range of benefits. Administrators need a firm grasp of the available options and programs—from retirement savings to health insurance.

Employees’ knowledge and participation in the benefits plan can be greatly improved with help from a benefits admin. New and long term employees will have questions about different policies and how to access benefits, and the administrator needs to be able to:

- Provide basic answers and assistance around benefits

- Guide employees through benefits-related education and paperwork

- Facilitate employee benefits training during open enrollment or onboarding

- Ensure employee handbooks and communication are kept up to date

Additionally, with the right benefits administration software, employees may be able to answer some of their own questions via an online portal. direct access to benefits information and policy choices

50%

anticipate additional increases over the next three years

source: EverythingBenefits.com

The majority of companies have increased their spending on HR technology connected to benefits of the past 10 years – and more than 50% anticipate additional increases over the next three years

Explore the possibilities of industry-leading technology & exceptional customer care with Netchex.

Essential Features of Benefits Administration Technology

Benefits administration involves lots of moving parts. Benefits administration software streamlines many of the actual tasks of benefits administration, as well as aiding accuracy and compliance. The right HR software can make benefits administration as efficient and simple as possible at your office.

Here are a few of the must have features for benefits administration software:

Compatible and easy to use

HR solutions need to be integrated with one another. Payroll and tax software integrated with benefits administration software handles pay deductions for insurance, retirement savings, and other routine benefits-related tasks. HR technology should also be scalable and easily customized to the unique set of benefits at your company.

15%

When employees do their own benefits administration online, it results in a time savings of 15% by HR staff

source: Smart Business Network Inc.

Built-in enrollment and employee self-service

New hires and changes to benefits require a ton of paperwork. Luckily, HR software can streamline that process with autofill data and EDI feeds directly to carriers.

Employees should have 24/7 access to a secure portal. Employees may need to update their insurance policy after a qualifying life event or during open enrollment. They may want to track their accumulation of PTO or verify how much they’re paying toward a particular benefit.

Nearly

1 in 3

of employees would like their employers to provide online benefits selection and decision-support tools

source: Employee Benefit Research Institute

Compliance and security

Make sure your company is Clear communication with employees and systems confirm when tasks and paperwork have been completed to remain compliant with regulations like the ACA and HIPAA.

Dealing with the personal data of employees, your benefits administration software must be as secure as possible. Make sure that employee data is protected at every stage of processing, especially when transferred online to the IRS and insurance service providers.

Employee education and training

A place where most companies struggle is benefits education. Employees need to be informed and aware of what is being offered. If you already have a Learning Management Solution, then custom training and education can be added to your current onboarding curriculum. Your BenAdmin software provider should also provide training resources and materials for your employees.

Knowledgeable customer support

Not all HR software providers are created equal when it comes to customer support. At Netchex, customer service is always a top priority. Thanks to our highly personalized, expert, and proactive approach to service, Netchex has one of the highest customer satisfaction scores in the industry.

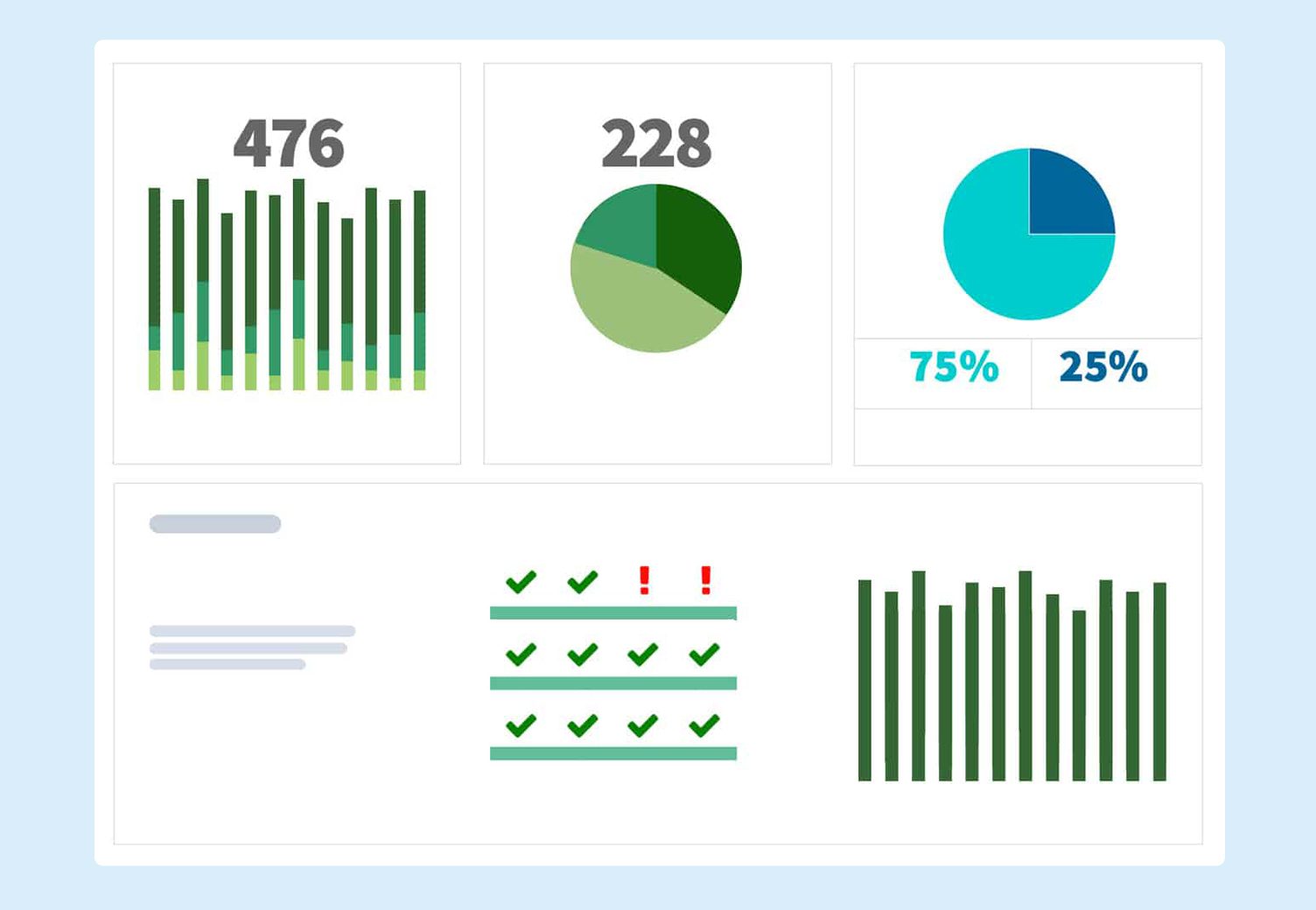

In-depth reporting and analytics

Benefits Administration software can compile an extensive range of comparative data for meaningful analysis and insights. Reliable, quantitative data can help form a complete picture of the relative success of different benefits programs. Get automatic reporting and analytics to better understand your workers and adapt to their needs.

Advantages of Using Benefits Administration Software

Your benefits administration system needs to work. It does NOT need to require extra work. The right HR technology improves the efficiency and accuracy of benefits-related tasks.

Between legal compliance issues and the danger of miscommunications with insurance carriers, BenAdmin software resolves a wide range of costly and frustrating problems, while also increasing employee education and engagement.

Here are just a few reasons to upgrade your employee benefits experience with BenAdmin software:

Save time and money

Benefits administration can get expensive, through third-party fees and costly errors. For HR departments, benefits administration can be a time-consuming challenge outside of their expertise. From enrollment to pay deductions, HR software takes much of the heavy-lifting of your HR team.

Costs $110

Manually enrolling an employee in benefits costs $110 vs. self-enrolling online which costs under $22

source: Smart Business Network Inc.

Minimize errors

Technology allows even a small HR department to manage benefits programs efficiently in-house, reducing the need to fill out countless forms and manually transfer data. BenAdmin software also allows employees to sign up for the benefits they actually want, reducing the errors that come with paper filing and working through third-party contractors.

4 out of 5

employees enroll in the wrong health plan

source: Benefit Focus

More clarity and communication

HR software improves the employee experience by removing barriers to employee awareness and communication about benefits. User-friendly employee self-service portals allow for greater transparency and broader access to benefits policies. Empower workers to make better use of available benefits.

Increase participation and engagement

Some benefits are more popular. Some employees are not even aware of all the benefits available to them. BenAdmin software can give you quantitative insights. With accurate data, you can adjust or remove unpopular benefits options. The most popular benefits programs deserve a bigger share of company resources.

1 in 3

workers are only somewhat satisfied with the benefits offered by their current employer, and are not at all satisfied

source: SHRM

Simplify onboarding and offboarding

The arrival and final departure of workers are the two stages of the employee lifecycle with the most HR paperwork. The right HR software can streamline and simplify onboarding paperwork, digitizing and auto-filling most of the repetitive forms.

You can even start onboarding new hires early with a Learning Management System (LMS). Departing employees need to complete COBRA paperwork, and software can document the completion of key forms during offboarding.

Support benefits compliance

Some benefits are required by law, depending on your industry and the size of your company. Benefits Administration software can help make sure that key paperwork has been completed and legal obligations have been met.

Missed payments and other mistakes can be costly for the company and employees. Your company’s liability and fines can also get expensive if you accidentally fall out of compliance.

You may have state and local regulations in addition to these federal standards.

- The Fair Labor Standards Act of 1938 (FLSA)

- The Employee Retirement Income Security Act of 1974 (ERISA)

- The Consolidated Omnibus Budget Reconciliation Act of 1985 (COBRA)

- The Family and Medical Leave Act of 1993 (FMLA)

- The Health Insurance Portability and Accountability Act of 1996 (HIPAA)

- The Affordable Care Act of 2010 (ACA)

Reinforce company culture

Popular and accessible benefits can improve company culture, employee satisfaction, and retention because employees feel valued and taken care of. A great benefits package can make all the difference when current employees and potential applicants compare their options at different companies. Demonstrate your investment in employee wellbeing and quality of life by making benefits easily accessible.

80%

of surveyed HR employees found that using HR technologies improved employee attitude toward the company

source: G2

Strengthen relationship with your benefits broker

BenAdmin software doesn’t eliminate the need for industry experts like employee benefits brokers. Instead, it allows for benefits packages to be tailored to the circumstances and demographics of your workforce. Give brokers more detailed insights into your employees and their priorities.

Maximize your potential with state-of-the-art technology & superior customer service from Netchex.

How to Get the Most Out of Your Benefits Plan

Optimize your benefits to better serve workers, and the results should be cost-effective for the whole company, reducing the expense of turnover and recruiting. Popular, useful benefits will additionally improve workplace morale and the whole company culture.

Here are several proactive benefits management tips to improve employee experience and strengthen your company’s benefits package:

The top two pieces of information job seekers look for when researching a company or looking at job descriptions are salaries (67%), & benefits (63%)

source: Gallup

Review current benefits package

Employee benefits need to be reassessed periodically. Sometimes a change to benefits packages or company policies will resolve routine headaches.

- How long has it been since you compared insurance policies and carriers?

- How many employees are taking advantage of your least popular benefits?

- Have long term employees been made aware of more recent changes to benefits?

- Do you tend to get the same questions and concerns from employees?

Manage benefits cost

Health insurance tends to get more expensive by the year, but that doesn’t mean you’re without options. Focus on cost containment and long-term savings.

If you’re considering a new carrier, look beyond short term discounts and incentives. Look for employee benefits management software and insurance carriers ready to scale with the future growth of your company, so that you don’t outgrow your benefits plan.

30%

of the total compensation for each employee is benefits, though costs continue to increase

source: U.S. Bureau of Labor Statistics

Align benefits with employees’ needs

Ask employees for feedback about your benefits to voice concerns and preferences. Identify potential gaps by researching employee demographics and needs. Think about employee wellness and work-life balance, priorities that weren’t discussed as frequently in past decades.

- How can your benefits support employee mental health and reduce burnout?

- Have you considered non-traditional benefits that are adapted to the needs of your employees, like discounts on local daycare and help with student loans?

- Also, should you consider location-specific concerns like employee parking, on-site amenities, or home office setup?

34%

of employees say they're unsatisfied with their current job benefits, up from 28% in 2021

source: Velocity Global

Evaluate both voluntary and employer-paid benefits

Employees sometimes cover the majority (or entirety) of the cost of some benefits, which makes them popular with employers. You might offer a partial match on programs like retirement savings, but other voluntary benefits are relatively inexpensive for the company.

Employer-paid benefits don’t require paycheck deductions, which can make them easier to manage. Employees appreciate having a variety of both types of benefits, including voluntary benefits that may only appeal to some.

Utilize employee benefits management software

Perhaps the most obvious of all. Onboarding, offboarding, and open enrollment are the times with the most HR paperwork. Integrated software allows you to dramatically reduce paperwork and routine administrative tasks, as well as manual errors. Find a benefits solution that communicates with payroll and tax software, and you can quickly and accurately handle paycheck deductions, too.

56%

of the work that human resources departments carry out associated to benefits can be automated by current technology

source: McKinsey Global Institute

Develop a communication and education plan

New benefits and big changes to policies often require education for current employees. Is this something your HR team can handle, or do you need to bring in outside experts? Most companies need help. HR technology provides all of that help and more, including an employee self-service portal and Learning Management System to explain your benefits offering.

101%

Employees who clearly understand what's covered in their benefits package are 101% more likely to trust company leadership

source: MetLife

More options = more flexibility

Explore expanding the voluntary benefits available for employees. This allows you to control the expense, while still giving employees access to the discounts that come with collective bargaining and company policies.

Don’t forget the underrepresented groups in your workforce. New benefits might help recruit a more diverse set of new hires, while catering too much to your current demographics might further disadvantage marginalized groups.

Benefits vs. Perks—and Why You Need Both

If those are benefits, then what are perks? Are they the same thing? If not, do I need both?

Part of an employee’s compensation package, employee benefits include things like health insurance and retirement savings, while employee perks are more like bonus incentives, such as an on-site gym and student loan reimbursement.

Employee perks tend to be less expensive for the employer, but benefits may be more vital to employees. Perks are a chance for companies to gain an even greater advantage by offering things that are more diverse and unique.

Why offer additional employee perks in addition to benefits?

Even if it’s hard to quantify the ROI, perks help your business stand out from the competition, especially when it comes to rewarding loyal employees.

In today’s highly competitive recruiting market, both employee benefits and perks give your company an edge over the competition in several areas:

Recruiting

When wages and other factors are comparable, employee perks can attract top talent.

Retention

Competitors may offer your employees financial incentives to leave, but perks give them a good reason to stay.

Employee well-being

Perks can make a big difference, especially when using the company’s collective power to secure in-demand services like mental health and daycare.

73%

of employees would be encouraged to stay with their current employer for longer if offered access to more benefits

source: MetLife

Five employee benefits you should already provide

Health insurance

Health insurance is a standard job benefit, while dental and vision insurance may be optional.

Life insurance

Life insurance provides peace of mind for employees, as surviving family members may struggle financially due to lost income.

Paid time off

Reduce burnout and spreading sickness by encouraging employees to take advantage of PTO.

Family leave

Parents cannot leave children home alone, and others may need to care for aging parents.

Retirement planning

Workers investing in retirement are less likely to treat their job as a short term gig, especially with matching employee contributions.

29%

of employees report having left a job or rejecting a job offer due to the benefits offered

source: Pacific Resource

15 emerging employee perks to consider

Flexible schedules and remote work

Floating holidays

Continuing education

Student loan reimbursement

Financial planning and education

Child care

Wellness programs

Gym membership

Discounts and corporate rates

Employee recognition and awards

Paid volunteer days and charitable matching

Pet insurance and pet-friendly office

Commuter benefits

Meal reimbursement and/or free food

Music/podcast streaming membership

90%

of workers have utilized four or more alternative perks, such as professional development and PTO for volunteering

source: UpCousel.com

Embrace the future of HR technology & elevate your customer experience with Netchex.

How HR Technology Elevates Employee Benefits Enrollment

Benefits enrollment can be a major stressor and time strain for HR staff. New hires are excited to learn about benefits and are sure to have plenty of questions. Long term employees also need help during open enrollment periods as deadlines get tighter.

The right HR software can help streamline benefits enrollment and offer a number of advantages to elevate the entire experience for all employees.

Open enrollment vs. new hire enrollment

Benefits enrollment is a predetermined period of time when employees may elect or change the benefit options available through their employer, such as health insurance and an array of ancillary benefits.

The biggest time for enrollment is when new hires first join the company. Employee onboarding usually includes an overview of benefits and related paperwork, even for those benefits that only become accessible after time. With HR software, benefits enrollment can begin before the employee’s first day in the office.

Some employees will change their mind about benefits year to year. The designated period for new policies and voluntary changes is called open enrollment. Though it varies by company, a common enrollment period is around November.

Check with vendors to verify dates and any changes to policies or paperwork. Employees will need reminders about open enrollment periods, paperwork, and deadlines, as well as continued benefits education.

20%

of employees say they don't keep up with benefits correspondence (e.g., attend company benefits meetings, read their plan descriptions, or throw benefits materials away unread)

source: SHRM

How to improve enrollment with benefits administration technology

Benefits administration software improves the enrollment experience for employees—as well as HR staff—by improving efficiency and accuracy while reducing frustration.

Here are several additional ways in which benefits administration technology improves the enrollment experience for all:

Reduced administrative hassle

Manual paperwork involves walking employees through each page, while missing items means chasing down employees as deadlines approach. Data transfer errors lead to missed, underpaid, or overpaid coverage.

Answering important questions

Digital benefits enrollment makes it easier for employees to get answers immediately. Experts can answer questions as they arise instead of saying “I’ll have to get back to you later.”

Improved communication

Employee portals provide an additional channel for messages and reminders. Don’t let deadlines, important forms, and plan education get lost in the email inbox.

Easier access 24/7

Around-the-clock access gives your workers a chance to thoughtfully research and compare policies. It allows them to get input from their spouse about options.

Increased engagement

Employees love the benefits they actually use. Give them more direct control through secure online portals. They’ll appreciate the freedom and measure of independence.

Streamlined paperwork

BenAdmin software replaces folders and binders with autofill digitized forms. Plus, connect securely with approved vendors for quick filing.

Saved time for all

Managers and HR staff don’t want to spend hours walking each employee through repetitive, manual paperwork. Likewise, employees appreciate the clarity and speed of digital portals.

Greater accuracy

Mailing forms and manual data entry both create opportunities for human errors. It’s easy for important changes to get lost in the shuffle between filing cabinets and binders.

Remote enrollment

Remote workers can sign up for benefits without an extra trip to the office, and new employees can get a jumpstart by filling out paperwork before their first day.

Better recordkeeping and data

Get automatic reporting and analytics to better understand your workers and adapt to their needs. Benefits administration software can compile an extensive range of data for analysis.

4 weeks

is lost each year waiting on misfiled mislabeled, untracked, or lost paperwork

source: Gartner

55%

prefer online enrollment methods versus just 16% who prefer a paper method

source: SHRM

62%

The majority of job applicants want a swift procedure, with 62% stating that it should take less than two weeks to complete

source: WebCare.com

Benefits Compliance: ACA, COBRA, and More

A major component of Benefits Administration is compliance. Just as time-consuming, stressful, and deadline focused as other elements of benefits paperwork, compliance (or rather failure to remain in compliance) comes with a hefty set of costly consequences (similar to payroll taxes).

40%

of companies either don't know enough about specific compliance rules or don't have the infrastructure necessary to comply with them

source: StartMyLLC.io

What you need to know about ACA compliance

Enacted in two parts, the ACA is a comprehensive set of healthcare reform laws and amendments. The legislation addresses health care costs, insurance coverage, and preventative care.

Since its inception, the Affordable Care Act (ACA) has had several requirements for employee benefits and annual reporting with some changes over the years. Particularly, the employer mandate requires employers with 50 or more full-time employees to provide access to “affordable and adequate coverage” healthcare coverage.

Learn more about ACA compliance and how HR technology makes it all easier:

Over 50%

of HR professionals state that they lack confidence in their capacity to keep up with the laws and regulations on their own since they change so often

Source: Center for Effective Organizations

What you need to know about COBRA health coverage and compliance

Losing a job, or even changing jobs, can mean the end of insurance benefits, in addition to income. For the past few decades, COBRA health insurance has made gap coverage for insurance more widely available, but what exactly is it and how does it work?

COBRA coverage provides a safety net for the newly unemployed and their dependents. It’s not always the cheapest insurance option, but it minimizes the disruption of benefits. Discover how to improve efficiency and reduce the room for error in your HR department by outsourcing COBRA health insurance administration with Netchex.

Discover everything you need to know about COBRA health insurance:

50 Years

The average COBRA enrollee is 50 Years Old but more younger employees are beginning to understand the value of this service

source: Employee Benefit Research Institute

Benefits Administration FAQs

Benefits administration is the organization and management of employee benefits-related tasks for your company. At most companies, benefits administration is the responsibility of the Human Resources department. Benefits administration involves a multitude of tasks, some of which can be automated or outsourced. Integrated HR technology improves the efficiency and accuracy of benefits administration.

The right HR software improves the efficiency and accuracy of benefits administration provided that:

– Most benefits will need to be managed throughout each employee’s lifecycle

– Annual open enrollment and life-change events must be conducted

– During onboarding, new hires must be educated and complete a lot of paperwork

– Departing employees need to be informed of continuing coverage and COBRA

Learn more about what benefits administration is and how HR technology makes it easier.

A benefits administrator serves as an advocate for employees and manages the full range of employee benefits. Benefit administrators need a firm grasp of the available options and programs—from retirement savings to health insurance.

Employees should be guided through all benefits-related education and paperwork. A benefits administrator should facilitate any employee training about benefits, whether during open enrollment or onboarding.

Employees’ knowledge and participation in the benefits plan can be greatly improved with help from a benefits admin. An administrator needs to be able to:

– Provide basic answers and assistance around benefits

– Guide employees through benefits-related education and paperwork

– Facilitate employee benefits training during open enrollment or onboarding

– Ensure employee handbooks and communication are kept up to date

Benefits administration software streamlines many of the actual tasks of benefits administration, as well as aiding accuracy and compliance. The right HR software can make benefits administration as efficient and simple as possible at your office.

Benefits administration software should:

– Be easy to use and integrated with HR software

– Include built-in enrollment and employee self-service

– Manage with compliance and data security

– Provide employee education and training

– Offer knowledgeable customer support

– Provide in-depth reporting and analytics

Discover how HR technology elevates employee benefits enrollment.

Benefits administration involves a multitude of tasks, some of which can be automated or outsourced with benefits administration software. Integrated HR technology improves the efficiency and accuracy of benefits administration.

– Most benefits will need to be managed throughout each employee’s lifecycle

– Annual open enrollment and life change events must be conducted

– During onboarding, new hires must be educated and complete lots of paperwork

– Likewise, departing employees need to inform of continuing coverage and COBRA

Employee benefits packages include a combination of core benefits and additional perks. Employee perks tend to be less expensive for the employer, but benefits may be more vital to employees.

Here are the most common benefits often to employees:

– Health insurance

– Life insurance

– Paid time off

– Family leave

– Retirement planning

– Dental and vision

– Disability and sick leave

– PTO and leave

Because it is so important and multi-faceted, employee benefits administration takes a significant amount of knowledge, time, and effort to manage across your workforce. It is an important role to fill by your HR team.

Benefits administration involves a lot of moving parts, including:

– Benefits provider research and selection

– Employee benefits education

– Open enrollment

– New employee enrollment (onboarding)

– Day-to-day benefits management

– Benefits compliance

– Benefits data analysis and reporting

Yes! When it comes to Benefits Administration at Netchex, comprehensive doesn’t have to mean complex. Netchex makes benefits Administration easy, straightforward, and worry-free.

– Enrollment & Administration

Easier enrollment and management empower employees to better control their benefits coverage.

– Carrier Communication

Eliminate the manual tasks associated with insurance carriers via digitized forms, EDI feeds, or NetEnroll.

– COBRA & ACA Administration

Employees won’t have to worry about the loss of benefits when they are in between jobs.

Compared to manual processing, a benefits administration system will save you significant time and effort. Specific time is dependent on company size, integration features, and other factors.

However, on average, HR staff can expect a 15% time savings by HR staff when using benefits administration software (source: Smart Business Network, Inc.)

Regardless of how much time is saved, benefits administration software enables HR professionals to focus more of their time and attention to your company’s most important resources—your employees.

The cost of benefits administration software depends on a number of different factors. Typically, this includes the number of employees, your company’s specific needs, and other similar factors. When comparing benefits administration software providers, it’s important to take additional benefits into account, like customer service, ease of use, and integration capabilities.

You can choose from one of our pre-built packages or speak directly with our sales team to create your own customized solution for your business. And because our solutions are available à la carte, as your business grows, Netchex can grow with you if you need to add more services later.

Click here to use our interactive calculator to see how much you could save by switching to Netchex.

Yes, but not all HR technologies are created equal. When considering benefits administration software, ease-of-use is always a major factor.

Some features that make Netchex’s benefits administration software easy to use are:

– Virtual enrollment

– Benefits experts on-hand

– Benefits education

– Employee self-service

– Increased communication

– Better overall employee experience

A lot of products say they are easy to use, but when we say it, we mean it. Netchex was recently named the easiest payroll and HR software by Software Advice. At Netchex, we have always prided ourselves on our system’s ease-of-use and overall user experience. Users praise Netchex for how easy the navigation and self-training features/resources are, in addition to highlighting how overall user-friendly the software is.

Discover the essential benefits administration software features that make Netchex easier to use for HR professionals, managers, and everyday employees.

Yes, the Netchex mobile app is a fully-functioning extension of the Netchex system. Benefits administration features, such as benefits enrollment, benefits deductions, overall benefits summary, etc. are all available in the mobile Netchex experience.

You can download our Netchex mobile application on both your Android and Apple (iOS) mobile devices.

Benefits administration software streamlines and automates much of the benefits management processes. It can help your business save time and money.

It also helps HR teams efficiently handle employee benefits related tasks, such as:

– Benefits enrollment

– Benefits eligibility

– Employee contributions

– Collect relevant data and create reports

– Ensure compliance with regulations

Learn more about benefits administration and how HR technology makes it easier.

Compensation refers to the financial rewards and benefits an employee receives in exchange for their work, including base salary, bonuses, and incentives. Benefits, on the other hand, are non-financial perks offered to employees, such as health insurance, retirement plans, paid time off, and wellness programs.

More simply; compensation directly relates to an employee’s income; benefits focus on enhancing their overall work experience and well-being.

Learn more about benefits and perks, and how they differ from each other and compensation.

Benefits administration software is primarily used by HR professionals and benefits administrators within organizations of all sizes. With benefits administration software, administrators can identify the benefits that employees want the most, provide the greatest value, and reduce overall costs.