4.7

|

80+ REVIEWS

4.7

|

80+ REVIEWS

Affordable & Reliable

Payroll Software

Request a quote

Don’t have a work email? No problem! Contact our sales team directly at: (985) 220-1410

6,500+ organizations trust Netchex

Full System Integration

A lot goes into payroll, and Netchex covers and connects it all with our integrated payroll software.

Flexible Pay Options

Multiple ways to pay, including direct deposit, standard checks, and paycards.

Tax Automation

Automated taxes and reporting save you time.

(Most Valuable Payroll) for Your Business

Netchex is a true team player providing access, information, and cross-functionality to every department in your company.

More Than Just A Paycheck

There’s more than one way to pay. Today’s workforce can be remote, seasonal, part-time, or salaried. And Netchex can be just as varied depending on your needs.

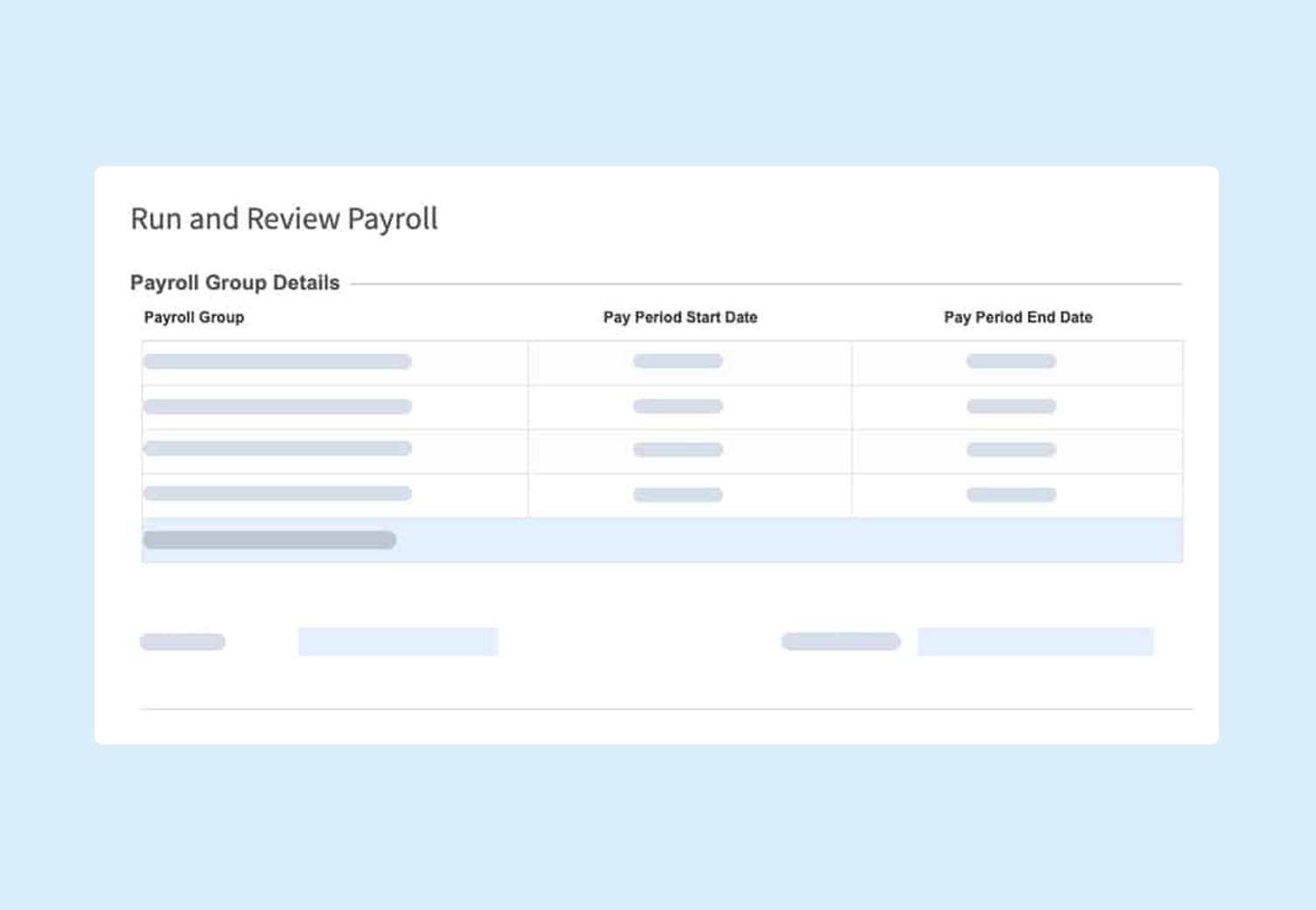

Accounting For Accuracy

Eliminate the oops, whoops, and uh-ohs with the help of Netchex payroll software. Pre-processing reports and analysis offers precision payroll that’s error-free every pay period.

Instant Preview Processing:

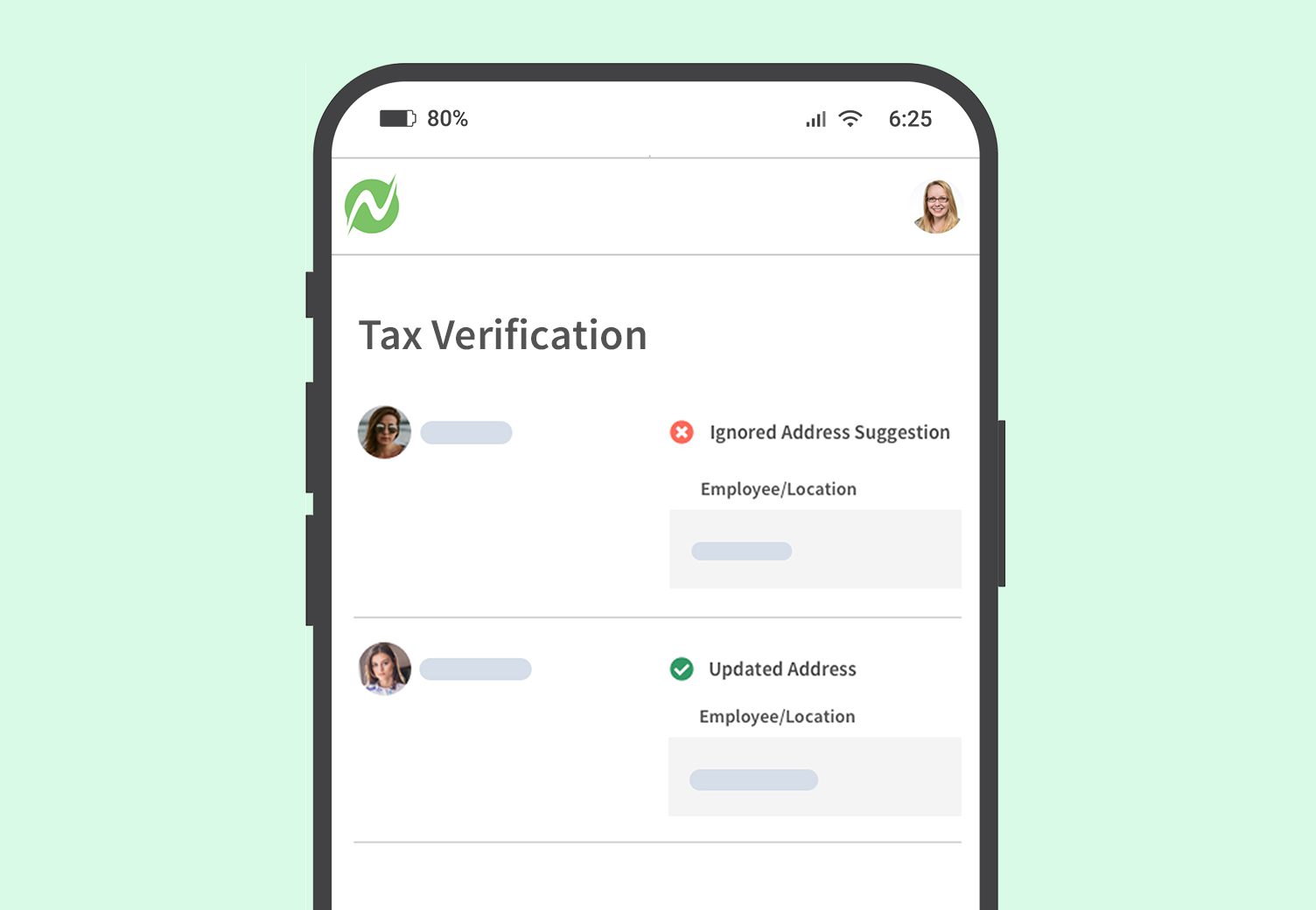

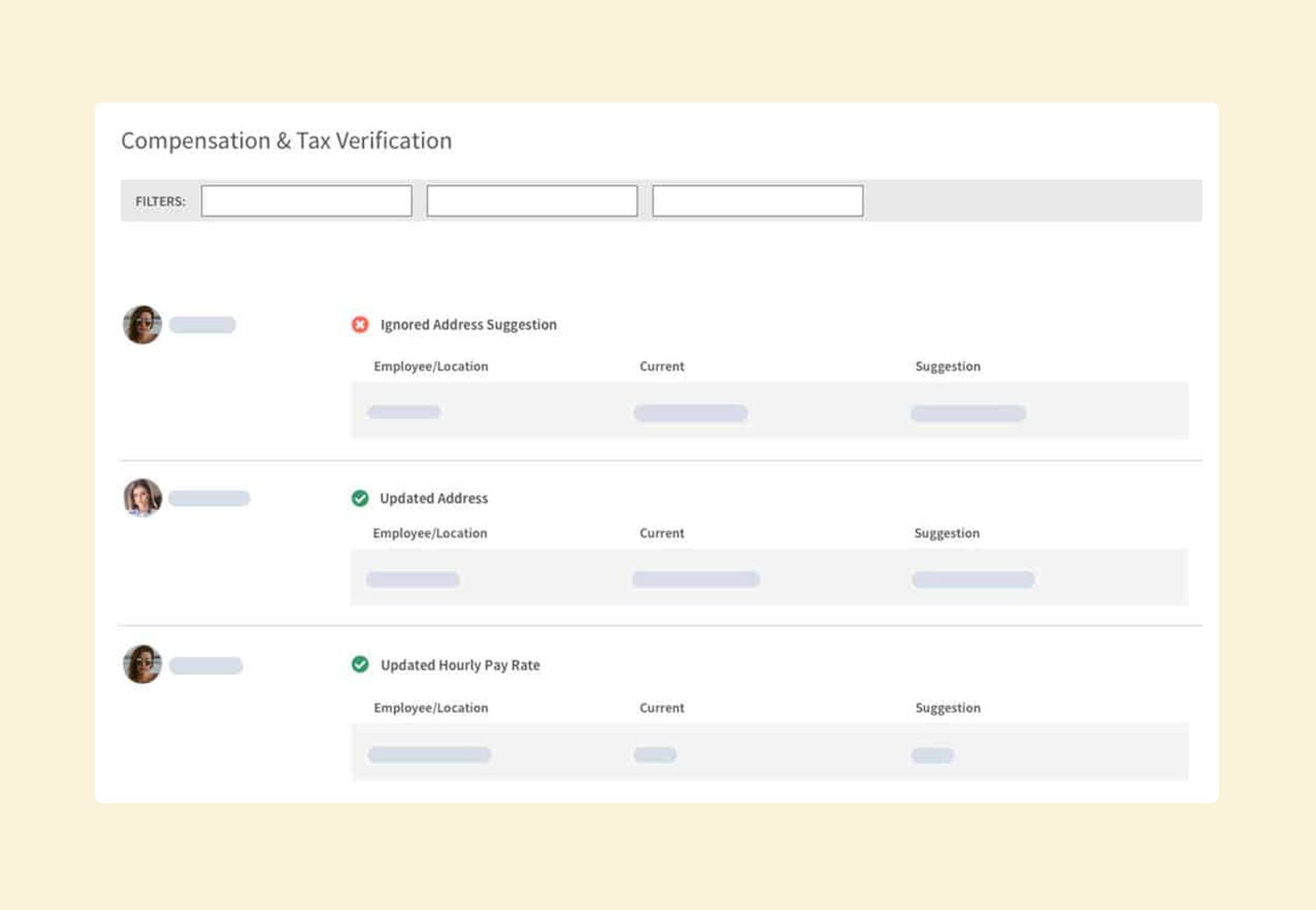

Tax and Compliance

Get tasks off your plate and worries off your mind. Automated taxes and reporting to help ensure accuracy—one less thing to think about, thanks to Netchex payroll software.

Our Address, Compensation, and Tax Verification (ACT) feature helps you ensure your employees are being taxed accordingly and paid the appropriate minimum wage based on their location.

Automation & Reporting

Featured Case study

The Colony ER Hospital

Before switching to Netchex in April 2019, The Colony ER Hospital was using ADP – and was not thrilled with their experience. As the facility administrator at their small business, Alexis found it impossible to manage and process payroll correctly with ADP in the event she had to trust another employee to do so. She did not find ADP’s flow of payroll software to be user-friendly, often causing errors.

Customers resoundingly love Netchex

- year after year

8.7%

U.S. sales of HR and payroll software grew 8.7% in 2020 In fact, sales have consistently increased by an average of more than 10% annually between 2015 and 2020.

source: IBISWorld

Today’s modern workforce not only wants workplace technology, employees expect it. The momentum behind HR and online payroll software has been building for more than a decade.

After the seismic shifts seen in the workplace in recent years, it is more crucial than ever to have reliable HR and payroll software. Now is the time to act or reassess your company’s HR and payroll technology needs.

If your company HAS NOT invested in HR technology, now is the time to do it. This ensures you can maximize your company’s potential. Otherwise, you may risk falling behind.

If your company ALREADY HAS some form of HR technology, now is the time to evaluate its effectiveness. Doing so allows you to:

- Measure overall ROI

- Seek further improvements to all your HR processes

60%

of companies use 5 or more different HR systems with HR professionals spending more than 512 hours a year maintaining the multiple systems.

source: Reward Gateway

Netchex provides that seamless experience through payroll technology. Payroll is the engine that runs and connects our entire suite of HR solutions. Our payroll software makes the administrative side of HR easier, smarter, and more efficient year-round—not just on payday.

What is payroll software?

Payroll technology manages all tasks associated with payroll from beginning to end. This ranges from calculating wages to filing payroll taxes. Business payroll software allows you to organize and simplify these complex processes to work towards an accurate and timely payroll.

The alternatives—manually running payroll in-house or relying on a jumble of disconnected software systems—are less than ideal ways to run payroll. Common objections with these methods typically include:

- Time-consuming, mundane processes

- Labor intensity for those running payroll

- Susceptibility for making mistakes

29%

of businesses use an outdated payroll process that has not been updated in 10 years or more, including antiquated platforms and manual spreadsheets.

source: The American Payroll Association

Payroll software is a labor-saving solution to all of your payroll problems. By automating the necessary requirements for running payroll, you reduce:

The time commitment

Manual efforts

Inevitable errors

Outsourcing Payroll

Anyone can run payroll

Quick and efficient

Easy and streamlined

Full integration

Safe and secure data

Automated taxes

Service team of experts

Built-in reporting & analytics

Accurate and error-free

Supports compliance

In-House Payroll

Requires dedicated employee

Time consuming for all

Complicated process

Subject to errors

No integration w/ HR functions

Lack of security

Tax complications

Lack of expertise

Cost savings

Manual reporting

What are the benefits of payroll software?

1. Assists with payroll accuracy

Payroll errors can be costly, compliance isn’t optional, and underpaid employees will revolt. Software makes the payroll process consistent and precise.

Only 60%

of employees are "very certain" that their paycheck deductions and net pay are accurate, with a further 27% only somewhat certain.

source: The American Payroll Association

2. Enables on-time payments

Just as important as accuracy, timeliness of payments is critical. Employees depend on their paychecks to be available on the expected day.

Almost 70%

of employees said that meeting their financial obligations would be difficult if their paychecks were delayed a week.

source: The American Payroll Association

3. Saves time and money

With automation, your HR team has more time to focus on more people-specific projects. Additionally, payroll and tax mistakes can be costly to resolve.

4. Offers multiple payday options

Employees want more options than just paper checks and direct deposit. Payroll cards are a burgeoning alternative and another step towards a cashless world.

5. Simplifies taxes

Invest in a robust payroll processing software solution that you can trust to handle local, state, and federal taxes. Calculations and routine payments should be automatic.

6. Secures personal data

Data security is no joke. Payroll data includes sensitive personal and financial information, which your employees need to know is safe.

7. Integrates easily with other HR software

Payroll should be the gateway to all other HR software solutions—from timekeeping and benefits to onboarding and performance.

8. Increases employee engagement and productivity

Online payroll software enables employees to actively participate in the HR process. This typically includes:

- 24/7 access to pay stubs

- Tax forms

9. Improves data and reporting capabilities

Discover why THIS YEAR you need to invest in payroll technology.

What are the necessary features of payroll processing software?

While specific features can vary based on both user and provider, payroll technology should include most (if not all) of these essential functions.

Accurately calculate wages earned for each employee

Integrate seamlessly with time & attendance and other HR technology solutions

Withhold taxes and other deductions from paychecks

Deposit tax payments to the appropriate recipient on-time

Pay employees accurately and on-time

Enable beneficial payroll reports

Facilitate easier new employee onboarding

Protect sensitive employee data and financial information

Empower employees with self-service functionality

It is vital to match your organizational needs with the appropriate business payroll software. You also want to make sure that you are aware of all features available to you so that you can efficiently utilize them and maximize ROI.

- Netchex allows you to customize your experience to only the services that will make a positive impact on your company and boost engagement.

- Our sales process is personalized to tailor fit our HR solutions to your company’s needs.

- Our Client Success representatives ensure you are getting the most out of the Netchex system, including features that you might not know you have.

Is payroll software easy to use?

New technology adoption among employees is often a major factor in the success of new HR software. Company-wide buy-in and implementation are key to any payroll technology system. Everyone has to use it—and use it effectively—for it to really work.

While aesthetic features like custom fonts and customizable color schemes won’t make a big difference for your business, these keys to technology adoption certainly will:

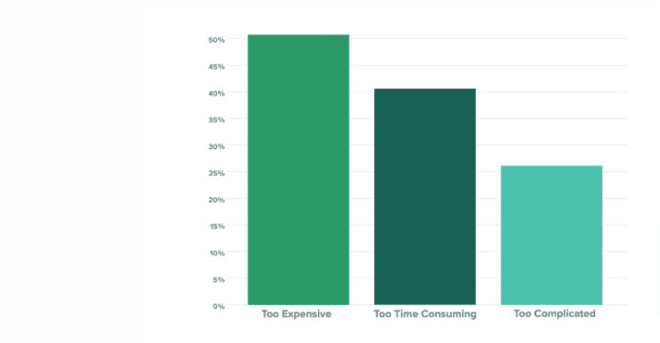

Small businesses see software adoption as too expensive (50.72%), too time consuming (40.58%), and too complicated (26.09%) of a process.

source: SelectHub

Quick and easy implementation

The implementation process needs to be streamlined to get your company up and running as soon as possible. Mutual cooperation between company and provider is critical.

User experience

Payroll software programs should be designed with everyday employees in mind, making it easy for everyone to find exactly what they need, when they need it. A rollout plan must consist of:

- Training

- Documentation

- Personalized assistance.

Customer service

Helpful and proactive service makes a big difference for users of all levels. With expertise and continuous training, customer service reps are instrumental in helping clients learn the system and solve issues whenever they arise.

Can payroll technology help with taxes?

Taxes are a major responsibility and a huge lift on your company. It is also the part of the payroll process that is the most prone to mistakes, which can prove very costly.

In 2019

the IRS levied almost 5 MIL penalties related to payroll taxes, totaling $13.7B

source: IRS

Employers have to withhold federal and state income tax from all employees’ taxable wages. Payroll software enables your company to file taxes automatically, helping you ensure everything is accurate and on time.

Employers have several mandatory tasks in handling payroll taxes. These often include:

- Figuring income tax withholdings and other employment taxes

- Depositing all employment taxes according to a set deposit schedule

- Reporting quarterly and/or annually on income tax withholdings, FICA, Social Security, and unemployment

Nearly 25%

of employees completed new W-4 forms during 2020-with the majority of those because workers wanted to change their tax withholdings or their financial circumstances changed.

source: The American Payroll Association

Additional FAQ about payroll software

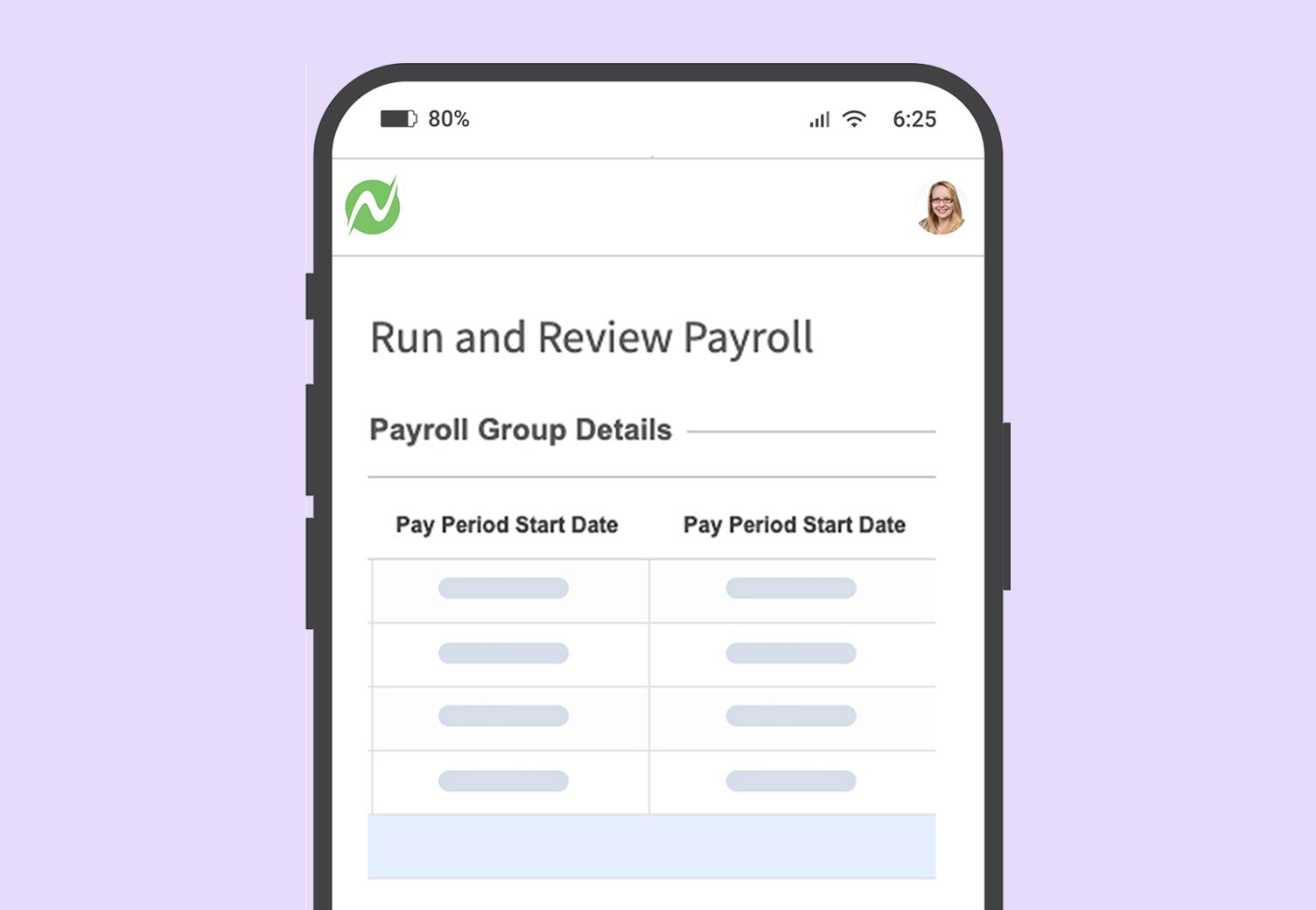

Yes! Netchex HR and payroll software is available as an all-in-one workplace technology solution. The Netchex app is a full service system designed to run the HR and administrative side of your company, including payroll processing, time & attendance, benefits administration, and more.

You can download our Netchex mobile application on both your Android and Apple (iOS) mobile devices.

Payroll software manages the entire payroll process from beginning to end, from calculating wages and filing payroll taxes. This technology allows you to organize and simplify these complex processes to ensure an accurate and timely payroll.

When searching for payroll software, look out for these essentials:

– Ease of use and simple payroll processing

– Tax compliance

– Flexibility in payment options

– Integrated time and attendance

– Easy employee onboarding

– Employee self-service

– High-level security

– Scalability and integration capabilities

– Reporting and analytics

– Expert customer support

Payroll software like Netchex can greatly reduce the chance for payroll errors. And even if errors do occur, Netchex makes it easier to identify and correct any issues in a timely and accurate manner.

Common payroll processing errors include:

– Missing/incorrect time punches

– Miscalculating pay

– Miscounting employee hours/overtime

– Incorrect time off calculations

– Misclassification of employees

– Misprocessing wage garnishments

– Incorrect payroll tax calculations.

Payroll errors do occur and can come at a high cost for businesses. Under both state and federal regulations, employers are required to pay employees for all wages earned and due. It is recommended that employers make payroll corrections immediately and not wait until the next pay period.

When you identify a payroll error, complete the following steps to ensure correction and compliance:

– Cancel the payroll processing, amend error(s), and reprocess payroll for the affected employee(s)

– Notify all relevant parties. Be transparent about the error and what is being done to fix it promptly

– Track the correction and keep a record of the payroll error

– Identify the cause of the error and identify how to prevent it from happening again

– Empower employees to verify their information, including payroll and timekeeping

Yes, Netchex is equipped with federal, state, and local tax filing to help you with HR compliance. Our payroll software is built to help with payroll and tax accuracy.

For payroll processing, payroll outsourcing is easier for anyone in the office to manage the paperwork with payroll software. Payroll software like Netchex makes the payroll process more consistent and precise, removing many of the tedious steps where it’s easy to make mistakes.

Compared to manual processing, a payroll management software will save you significant time and effort. Specific time is dependent on company size, integration features, and other factors. In addition to saving time (and money), payroll software enables your HR professionals to focus more of their time and attention to your company’s most important resources—your employees.

Payroll processing cost depends on a number of different factors. Typically, this includes the number of employees, your company’s specific needs, payroll frequency, and other similar payroll and company factors.

When comparing online payroll software, it’s important to take additional benefits into account, like customer service, ease of use, and integration capabilities.

With Netchex, you can choose from one of our pre-built packages or speak directly with our sales team to create your own customized solution for your business. And because our solutions are available à la carte, as your business grows, Netchex can grow with you if you need to add more services later.

Click here to use our interactive calculator for an estimate on how much you could save by switching to Netchex.

Payroll software can significantly streamline your company’s payroll process by automating tasks such as calculating wages, processing deductions, and generating paychecks. Learn more about how payroll software works, the time and money savings, and additional benefits of payroll software.

Most payroll software is designed to integrate with popular accounting systems, such as QuickBooks, Xero, and Sage. However, it’s crucial to check compatibility and ensure that the payroll software you choose can seamlessly sync data with your existing accounting software to maintain accurate financial records.

Yes, payroll software is built to handle complex tax calculations and help you comply with various federal, state, and local regulations. Learn more about payroll taxes, including payment requirements, potential penalties, and relevant deadlines.

When choosing payroll software, key features to consider include ease of use, scalability, integration capabilities with other systems, tax filing, and compliance support, customizable reporting options, and employee self-service features.